Interconnection publishes a powerful portfolio of market studies, providing off-the-shelf solutions for a wide range of product areas in Refrigeration. Our reports provide analytical insights on the ‘European Refrigeration equipment Market’ with focus on Refrigerated Cabinets, Cold Rooms, Commercial Refrigeration and Domestic Refrigeration. The objectives of this study are: To estimate and forecast the global refrigerants market size in terms of…

> read more

Refrigeration Systems

Market Report, Industry Report, Market Study, Industry Analysis

Detailed Market Data and Information about Refrigerated Cabinets

Refrigeration Systems

Monika Pan

Monika Pan studied Financial Management at the University of Warsaw and the Comenius University in Bratislava. She first specialized in tax analysis, then data analytics and project management were added to her role. At Interconnection Consulting, she handles worldwide market reports and consulting projects of diverse focus with an emphasis on data visualization.

Contact me without obligation, I support you gladly!

Report Offers

IC News

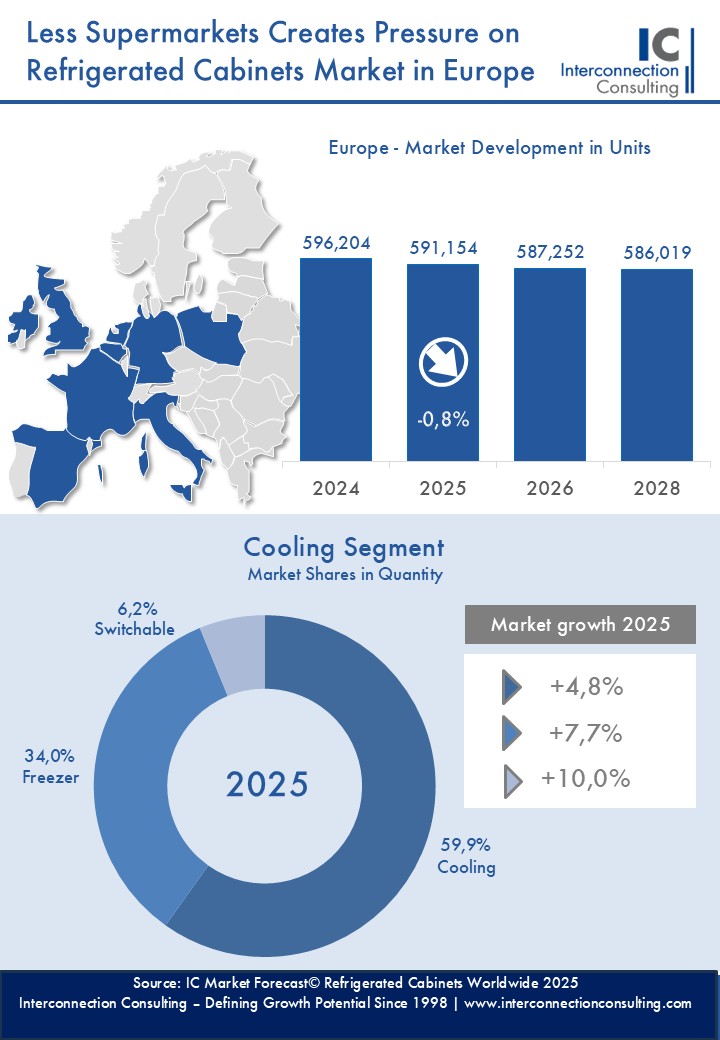

Freeze Market for Refrigerated Cabinets

The European refrigerated cabinets market remains in decline, with a -2.5% drop in 2024 and a projected -0.8% decrease in 2025, stricter refrigerant gas regulations, economic uncertainty, and fewer incentives for renovations are impacting sales across the continent, according to the latest Interconnection Consulting’s IC Market Tracking Refrigerated Cabinets 2025 study.

Germany stands out as an exception, growing 0.6% in…

The European refrigerated cabinets market remains in decline, with a -2.5% drop in 2024 and a projected -0.8% decrease in 2025, stricter refrigerant gas regulations, economic uncertainty, and fewer incentives for renovations are impacting sales across the continent, according to the latest Interconnection Consulting’s IC Market Tracking Refrigerated Cabinets 2025 study.

Germany stands out as an exception, growing 0.6% in 2024 and 1.4% in 2025. This growth is driven by retailers upgrading equipment to meet new legislations and improve energy efficiency. In contrast, France is expected to fall -1.9% this year and another -1.2% in 2025, as economic and political instability make financing harder to obtain. The UK faces the steepest decline, with sales dropping -9.9% in 2024 and -5.0% in 2025, largely due to the economic crisis and Brexit-related import challenges.

Despite fewer units being sold, market value continues to rise, reaching €1.676 million in 2024. This increase is driven by new technologies that improve energy efficiency and compliance, as well as rising raw material costs.

On a global scale, China is experiencing strong growth, up 15.4%, fueled by increased demand for frozen products. Meanwhile, the U.S. follows Europe’s trend, declining -2.0% as economic struggles limit investments in the retail sector.

The market is dominated by leading companies like AHT Cooling Systems, Arneg, Bonnet Névé, Coreco, Epta, Frigoglass, Hauser, Hoshizaki, Imbera, Johnson Controls, LG Electronics, Liebherr, Metalfrio, True Manufacturing, and Viessmann. Together, they control almost 52% of the global market, these companies drive growth through innovation and use their worldwide presence to stay strong despite the ups and downs of the industry.

[^]European Refrigerated Cabinet Market Races Ahead

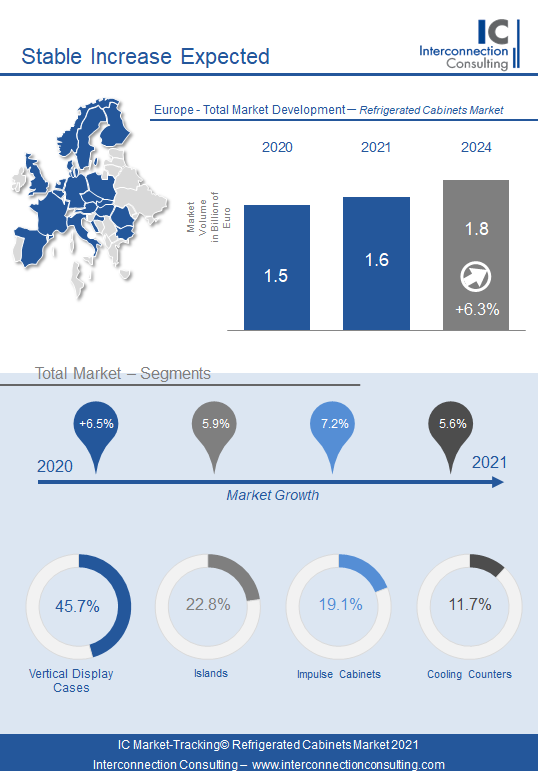

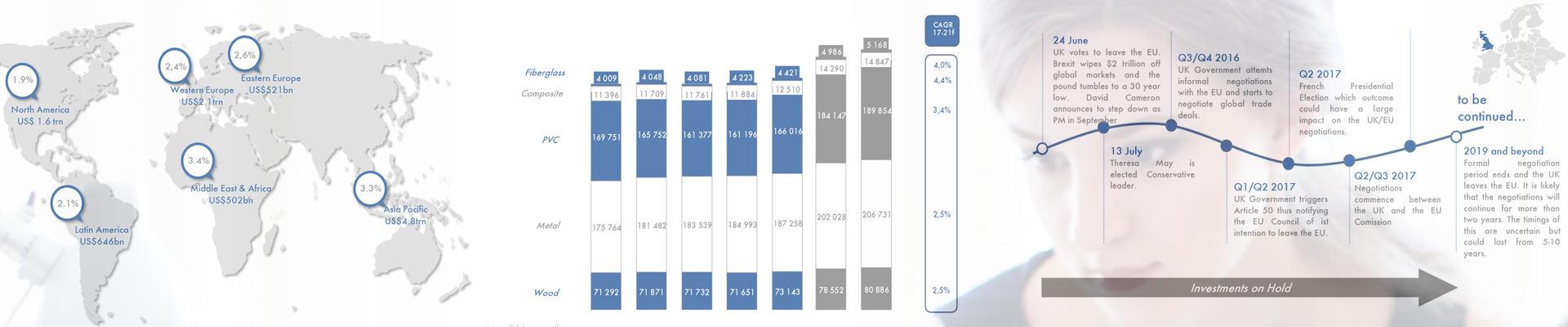

The European food retail refrigerated cabinet market recorded a 7.2% increase in 2021, reaching a turnover of €1.6 billion. This increase came after a 6% drop due to the COVID crisis the year before.

From today’s perspective, the market will grow by 6.3% annually in value until 2024. One of the key factors making the food retail refrigerated cabinet market so dynamic is the demand for fast-moving consumer goods. Many of these…

The European food retail refrigerated cabinet market recorded a 7.2% increase in 2021, reaching a turnover of €1.6 billion. This increase came after a 6% drop due to the COVID crisis the year before.

From today’s perspective, the market will grow by 6.3% annually in value until 2024. One of the key factors making the food retail refrigerated cabinet market so dynamic is the demand for fast-moving consumer goods. Many of these products have a short shelf life and require cool storage. Due to the ever-increasing supermarket density in Eastern European countries, the demand for processed goods is therefore increasing and, as a consequence, the demand for refrigerated display cabinets.

Slow Switch to Environmentally Friendly Products

The general concern for the environment is leading to increasingly ecological solutions in all sectors of the economy. The refrigerated display case industry in the food segment is no exception. Synthetic solutions such as hydrofluorocarbons (HFCs) can deplete the ozone and cause environmental damage. Therefore, many companies have decided to make the switch to natural refrigerants, such as ammonia or CO2. “In the next few years we are very likely to see an explosion of new sustainable options. CO2-based systems are very likely to play a major role in this in the future,” says Sasha Spiridonov, the author of the study. CO2 is not only sustainable, but also energy-efficient and non-combustible. Western European countries are already much further ahead than the CEE countries when it comes to the switch to more environmentally friendly CO2 cooling systems. In Germany, CO2-based cooling systems already constitutes 16% in volume. Overall, however, the share of hydrofluorocarbon systems is still far ahead at 75%. The somewhat sluggish shift towards environmentally friendly solutions can also be explained by the cost of the changeover, which usually goes hand in hand with a more complex cooling architecture, says Spiridonov.

Remote Continues To Gain Ground

Remote refrigeration units are subject to electronic control. They do not have their own cooling unit, but are connected to a central cooling unit on site. This form of cooling takes up the largest part of the market with a volume of 900 million euros and a growth of 7.8% last year. This means that the remote segment continued to gain market share. The remote segment is strongly dominated by wall refrigeration units, with a market share of 67%. Refrigerated counters come in at 20.5% and refrigerated islands at 12.5%. On the other hand, plug-in systems also achieved stable growth rates with an increase of 6.6% and reached a total volume of 755 million euros. Plug-in systems are ready-to-plug-in refrigeration units that do not require any further system components. They are refrigerated cabinets with an integrated refrigeration unit. They require less maintenance than centrally controlled units. However, remote cooling units are cheaper overall because a lot of energy is saved on cooling and the warm air that escapes can be reused. Furthermore, the cleaning of remote cooling units can be reduced to once or twice a year and the contamination factor is lower.

Italian Market Leaders

The market for refrigerated cabinets remains very concentrated. Italian producers such as Arneg, Epta, De Rigo dominate the market together with Carrier and AHT. Nevertheless, Polish providers in particular are penetrating the market with cheaper solutions and are gaining more and more market share.

The study examined the following countries: Germany, Italy, UK, France, Benelux, Austria, Czech Republic, Slovakia, Hungary, Norway, Sweden, Denmark, Croatia, Romania, Bulgaria, Poland.

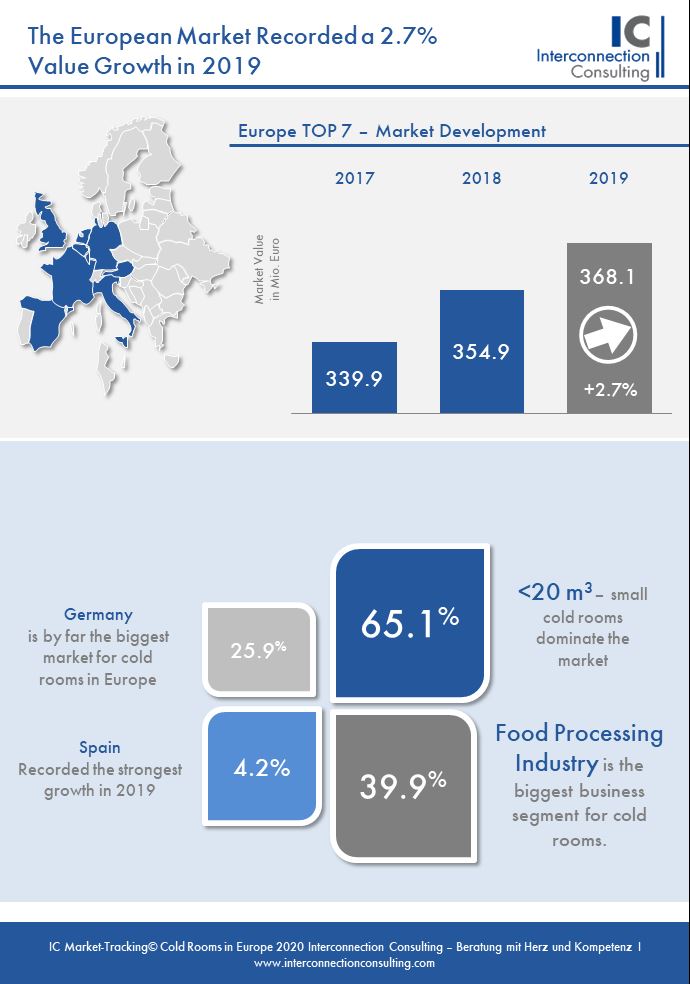

[^]Strong Fragmentation of the Cold Rooms Market in 2019

The cold rooms market in Germany, Italy, Spain, France, UK, Benelux and Austria recorded an increase in both quantity and value sales of 3.7% and 2.7% respectively. This upward trend is not expected to continue over the forecast period due to the overall stagnation of economy in the euro area. The market is expected to see an annual average growth rate of below 1% over the next three years, reflecting the economic situation…

The cold rooms market in Germany, Italy, Spain, France, UK, Benelux and Austria recorded an increase in both quantity and value sales of 3.7% and 2.7% respectively. This upward trend is not expected to continue over the forecast period due to the overall stagnation of economy in the euro area. The market is expected to see an annual average growth rate of below 1% over the next three years, reflecting the economic situation in the EU and the expected forecast of gross domestic product (GDP) which is forecast to expand by 1.1% in 2020 and by 1.2 % in 2021.

German Cold Rooms Market Leading Sales in 2019

The total market for cold rooms in the Europe Top 7 (Germany, Italy, Spain, France, Benelux, UK and Austria) experienced an increase of 2.7% in terms of quantity sales, reaching 103,550 cold rooms sold in 2019, while the value sales reached EUR 368.1 million, experiencing an increase of 3.7%. The German market was the biggest in 2019 in terms of quantity sales, accounting for a 25.2% recording an increase of nearly 3%. The market was strongly influenced by the growth within the small cold rooms segment (<20 m³). This segment recorded a strong increase in 2019 of 4.9%. On the other hand the 100-400m³ segment recorded a decrease of 2.8%. This particular trend towards the small cold rooms in Germany is expected to continue over the forecast period. This segment is expected to see an average annual growth of around 1% over the forecast period, while the 100-400m³ is expecting to see a negative development. Both segments will strongly be influenced by the expected slowdown of the retail industry in Germany. The second best market in terms of quantity sales in 2019 was UK which accounted for 18.2%, followed by France with 14.6%, Italy with 13.4%, Spain which accounted for 12.3% and Benelux with around 10%.

Food Processing Industry Generating the Strongest Demand for Cold Rooms

In 2019 the food processing industry was creating the strongest demand for cold rooms in Europe with around 40% of the total number of cold rooms sold in 2019, followed by food service industry with 35.9%, while the specialized food retail industry accounted for a share of around 24%. The food processing industry is a mature sector which is experiencing a turbulent period due to the growing global demands for food safety, increasing food insecurity and consumer demand for higher quality and sustainability; however its importance in creating a strong demand for cold rooms is not expected to diminish over the forecast period.

Strong Trend Towards Customized Cold Rooms

In 2019 factory built cold rooms accounted for 28.4% of the total number of cold rooms sold, while customized i.e built on site cold rooms accounted for 71.6%.

The market is rapidly moving towards customized cold rooms and this trend is expected to reach its peak in 2022. The reason for this particular trend should be seen in meeting the demands of consumers (customization based on real needs and space) and price pressure. Control of installation quality for cold rooms built on site is not that strict, compared to factory built cold rooms.

Strong Fragmentation of the Market in 2019

In 2019 the cold rooms market was quite fragmented with domestic players holding the strongest positions. On the national level the market concentration is very high. In Germany for the Top 10 companies accounted for 76.9% of the total sales, in Italy even stronger 81.2%, France 77.1%, UK 70.2% and Spain 76.0%. However, when it comes to the total market (surveyed countries) the market concentration is not that strong. The Top 10 companies account for 48.2% of the total volume sales, indicating how strong the fragmentation of the market actually is, and that none of the companies established enough influence to move the industry in a particular direction.

The Industry is Facing Challenges

Whilst high costs and instability are likely to cause friction and potentially stop businesses from taking risks, the increase and variation in consumer demand continues to fuel the industry. The cold rooms market is set to see a modest increase over the forecast period at an annual average growth rate of around 1% to reach EUR 364.8 million in 2022.

[^]Leading Companies trust in Interconnection Consulting

Scandinavian Business Seating

The IC Report gives a very good overview of the Western European office furniture market, in a well-structured way. The data is helpful to better understand the market developments and drivers.

Beatrice Sotelo (Director Business Development , Scandinavian Business Seating)

Kontron

The most important benefit of the Impulsworkshop "sales optimization" was in my view the procedure of the definition of strengths and the entire sales process. Mr. Berger is very competent and professional. Fabian Freund (Sales Manager, Kontron Austria)

ELK

The prefabricated housing study by Interconnection Consulting shows a real picture of the actual market situation and forms a valuable basis for our strategic decisions.

Gerhard Schuller (CFO ELK)

Epson

EPSON is satisfied with the Interconnection's way of communication with the market and with clients. EPSON is also appriciate the Interconnection's continuous work trying to aim the report to be at the higher level. As a result, EPSON rely on Interconnection data, for the market of POS Printers and Systems.

T.Murakami (Brand Management, Seiko Epson Corporation)

Gaulhofer

I appreciate on the forum "Impulsworkshop Vertriebsoptimierung" the practical relevance of Peter Berger linked with his practical examples. I also liked the sovereign presentation style. The most important benefit was for me, on the one hand refresh of methods and also the sales management tools that were shown. Ing. Dietmar Hammer (Head of Product Management Gaulhofer)

Kontron

The most important benefit of the Impulsworkshop "sales optimization" was in my view the procedure of the definition of strengths and the entire sales process. Mr. Berger is very competent and professional. Fabian Freund (Sales Manager, Kontron Austria)

Österreichs Personaldienstleister

The sales management tool "Jobs Intelligence Austria" has become indispensable for many Austrian temporary staffing providers for fast and correct strategic management decisions as well as a daily support tool for hot leads for the sales team. Interconnection Consulting has consider individually to all user needs during development process and also convinces with fast response times during operation.

Dr. Gertraud Höltl (Generalsekretärin Österreichs Personal Dienstleister)

Saint Gobain

Long experience and deep understanding of the construciton industry markets make up the quality of the IC studies. Interconnection Consulting is a constant companion concerning the assessment of markets and helpful for decision-making.

Bernd Blümmers (Directeur General, Saint-Gobain Solar Systems, Central Europe, Aachen)

Salamander

Interconnection Consulting reports deliver a worthfull external perspective and are so a good contrast with regards to our internal market point of views.

Pedro Posada (CEO Salamander Industrial Products Spain)

Scandinavian Business Seating

The IC Report gives a very good overview of the Western European office furniture market, in a well-structured way. The data is helpful to better understand the market developments and drivers.

Beatrice Sotelo (Director Business Development , Scandinavian Business Seating)

Schneider Electric

Under a short time constraint, Interconnection was able to deliver an outstanding study that exceeded my expectation in terms of quality and market breadth. I highly recommend Interconnection to anyone in need of market research.

Jeff Canterberry (Director of Strategy and M&A, Schneider Electric)

Sodexo

When developing new market strategies, Interconnection is a trusted source we always come back to. Christian Frey (Marketing Manager CS DACH)

Do not hesitate to contact us

Please describe your needs or request a callback. We look forward to hearing from you and contact you immediately.

Thank you very much for contacting us!

Our expert will contact you as soon as possible

Thank you for your Newsletter registration.

You will receive an automatic confirmation of registration at your specified email address.

Thank you for your order.

Please return the signed order form via email to office@interconnectionconsulting.com or via fax +43 1 5854623 30.

Thank you for your interest.

You will shortly receive the information material to the specified e-mail address.

For questions, we are happy to help!

Thank you for your interest.

You will shortly receive the information material to the specified e-mail address.

For questions, we are happy to help!

© 2025 Interconnection Consulting | Imprint | Privacy-Protection