As one of the leading market research institutes in the world in the area of façades, Interconnection Consulting regularly examines almost the entire spectrum of the facade market.

This includes sandwich panels with a wide range of different materials (steel, aluminum, and others) and various core materials (PUR/PIR, mineral wool, etc.), curtain wall facades (also known as elemental facades, mullion and transom facades, or unitized curtain walls,…

> read more

Facades

Market Report, Industry Report, Market Study, Industry Analysis

Detailed Market Data and Information about Sandwich Panels

Facades

Katarina Hornikova

> Learn more about Katarina Hornikova

Katarina Hornikova has been working for Interconnection Consulting since 2017. She specializes in international business strategies, international marketing, as well as the development tendencies of the specific international goods markets. She is responsible for the preparation of studies and market forecasting models within the construction industry. She studied International Trade Management and International Business.

Contact me without obligation, I support you gladly!

Report Offers

These industries might be interesting for you too

IC News

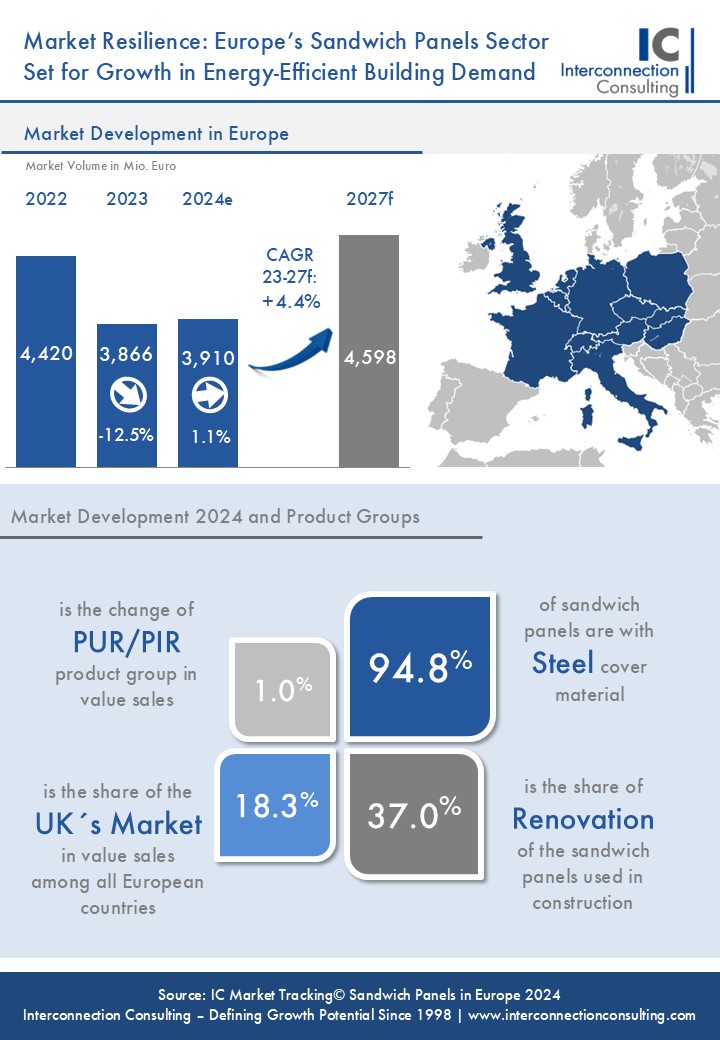

Resurgence in European Sandwich Panels Market as Value Hits EUR 3,910 Million in 2024

After hitting its bottom in 2023, the market for Sandwich panel has rebounded and is experiencing stable development in 2024. Market projections show 1.1% increase in value sales in 2024, reaching EUR 3,910.5 million. Quantity sales represent 125.8 million square meters, nearly 0.2% above the overall result from 2023 according to a recent market report by Interconnection.

Gently landing after turbulent times

Prior to…

After hitting its bottom in 2023, the market for Sandwich panel has rebounded and is experiencing stable development in 2024. Market projections show 1.1% increase in value sales in 2024, reaching EUR 3,910.5 million. Quantity sales represent 125.8 million square meters, nearly 0.2% above the overall result from 2023 according to a recent market report by Interconnection.

Gently landing after turbulent times

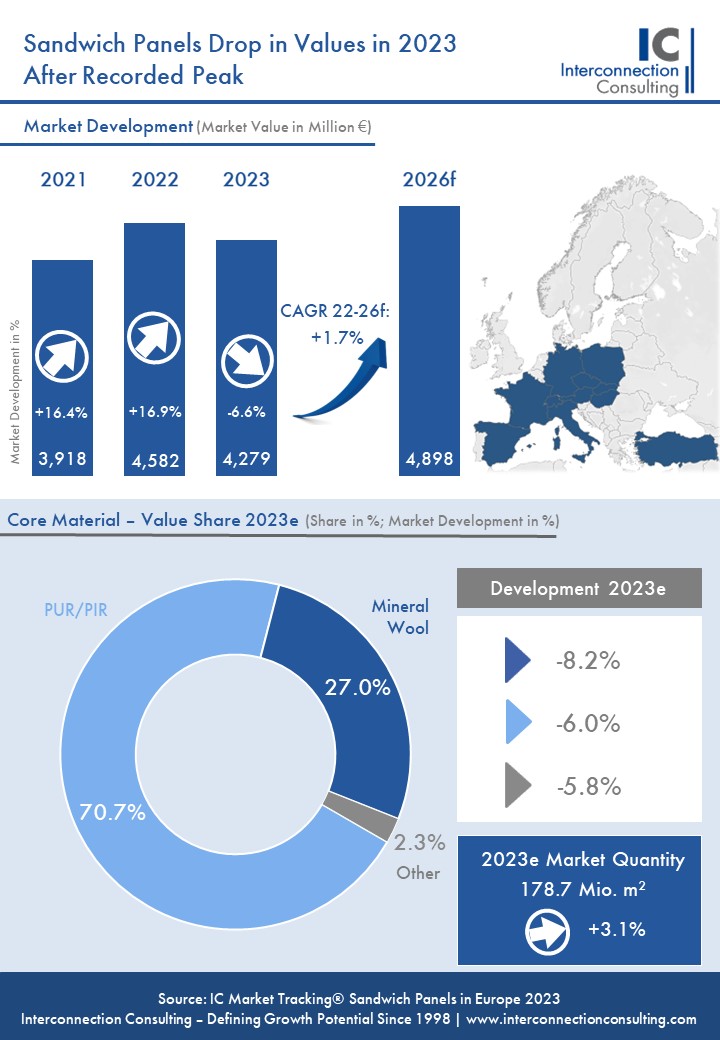

Prior to this development, the market peaked in 2022—EUR 0.5 billion above its 2024 total—driven by high inflation, strong product demand, and a surge in construction activity. However, a correction followed in 2023 as construction activity slowed, inflationary pressures eased, and input costs, such as steel, began to decline. This cooling effect deflated the price bubble, with the average price correction -8.1%, bringing the market to a more balanced state in 2024, as detailed in Interconnection’s study.

Pole position does not guarantee success

As the situation in 2024 may seem balanced, the development across countries differs. Germany, the biggest market for sandwich panels in 2023, is losing its breath due to downturn in construction activity underscored by domestic and foreign geopolitical uncertainty. Germany is anticipated to be overtaken by even two countries – the United Kingdom and Italy. According to Interconnection data, the prospects for total value sales in the United Kingdom are EUR 715.6 million in 2024.

Product group preferences

The most preferred core material is PUR/PIR, with 70.7% share in quantity sales. This preference is driven by its lower price and the need for thinner insulation compared to mineral wool. However, mineral wool has better prospects for increased demand in the coming years due to its fire resistance, ecological benefits such as recyclability and sustainability. Mineral wool reaches 27.0% market share in 2024, with a growth rate of 0.5%, higher than the market average. Steel sheet remains the dominant cover material for sandwich panels, holding a strong 94.8% market share, ahead of aluminum and other materials.

Dominance in segment trends

By building type, where sandwich panels are used, the most popular are warehouses, production halls, and agricultural buildings, together accounting for over 70.3% of the total usage of panels. On the other hand, data centers have seen the greatest growth, increasing by 2.2%, despite holding the smallest share of the total. Subsidies for renovation in some regions and the push for energy efficiency are driving the demand for thicker materials. The renovation segment is expected to grow by 1.5%, while the segment using materials thicker than 100mm is expected to grow by 1.0%, while other segments either stagnate or decline.

Market competition landscape

The sandwich panels market remains concentrated, with many mergers and acquisition performed mainly by the market leader Kingspan. Together with ArcelorMittal, Lattonedil, Isopan and Tata Steel (including subsidiaries) the TOP5 producers are holding almost two thirds of overall European market. Nevertheless, minor producers play also important role due to their geographical proximity to customers.

Interconnection Consulting’s report examines and analyzes the forecast market trajectory for the following European regions: Austria, Benelux, Czechia, France, Germany, Hungary, Italy, Poland, Slovakia, Switzerland, the United Kingdom, and separately the United States.

[^]From Record Highs to a Downturn: European Sandwich Panels Market Faces a 7% Value Drop in 2023 After a Historic Year in 2022

Contrasting Market Realities – The European Sandwich Panels Market experienced a year of unprecedented success in 2022, reaching historic sales peaks. However, in 2023, the market encountered a significant setback, witnessing a stark 7% decline in values according to a recent market report by Interconnection Consulting.

In 2022, the European Sandwich Panels Market reached a volume of an impressive 178.8 million square meters.…

Contrasting Market Realities – The European Sandwich Panels Market experienced a year of unprecedented success in 2022, reaching historic sales peaks. However, in 2023, the market encountered a significant setback, witnessing a stark 7% decline in values according to a recent market report by Interconnection Consulting.

In 2022, the European Sandwich Panels Market reached a volume of an impressive 178.8 million square meters. Market development saw a remarkable change in quantities by 3.1% when compared to previous year. The year 2022 witnessed several impactful factors that influenced the market. The high inflation rate, the Russia-Ukraine conflict, and subsequent supply chain disruptions, coupled with fears of raw material shortages, elevated production costs, etc.

Despite these challenges, increased demand, albeit at higher prices, led to a growth in quantities in 2022. From the point of view of values, the price inputs turbulences resulted in a dramatic growth of the market by 16.9% in values, whereby the market reached its historical peak at 4.6 billion euros as the result for 2022.

Turkey’s Triumph in the European Landscape

The study emphasizes Turkey’s significant growth potential within the European market. Not only does Turkey boast the largest sales in quantities, but it also exhibits the most substantial growth potential, with a compound annual growth rate of 8.1% until 2026. Germany, the second-largest market in quantities, is anticipated to remain stagnant in sales until 2026 (-0.3% pa).

However, Germany leads in value sales in Europe, achieving 877.7 million euros in 2022.

Dominant Segments and Evolving Preferences

The study reveals that the PUR/PIR core material stands out as the dominant segment across Europe, accounting for over 75% of the market share, followed by mineral wool at around 22%. Mineral wool, known for its fire-resistant features, is the trending material in most European countries. Notably, Turkey deviates from this trend, favouring PIR core material. Steel cover material asserts dominance in all markets with over 94% market share. The analysis of insulation thickness indicates a growing preference for the > 100mm category, which experienced a substantial 6.7% growth, driven by the increasing demand for energy-efficient buildings in Europe.

Competition relationships and area covered by the analysis

The IC Market Tracking® offers deep insight into the sandwich panels market competition environment across the covered countries, which encountered many turbulences in 2022. The main players remain ArcelorMittal, Assan Panel, Brucha, Huurre Ibérica, Isolpack, Isopan, Italpannelli, Kingspan, Lattonedil, Marcegaglia, Metecno, Panelais, Romakowski, Saint-Gobain, Tata Steel and Trimo.

The study examined following countries in the European Region: Austria, Czech Republic, France, Germany, Hungary, Italy, Poland, Slovakia, Spain, Switzerland, and Turkey.

Interconnection Consulting’s report not only sheds light on the past market performance but also provides invaluable insights into the future trajectory of the European Sandwich Panels Market, enabling industry players to make informed decisions and strategies in this evolving landscape.

Price Surge in the Sandwich Panel Market

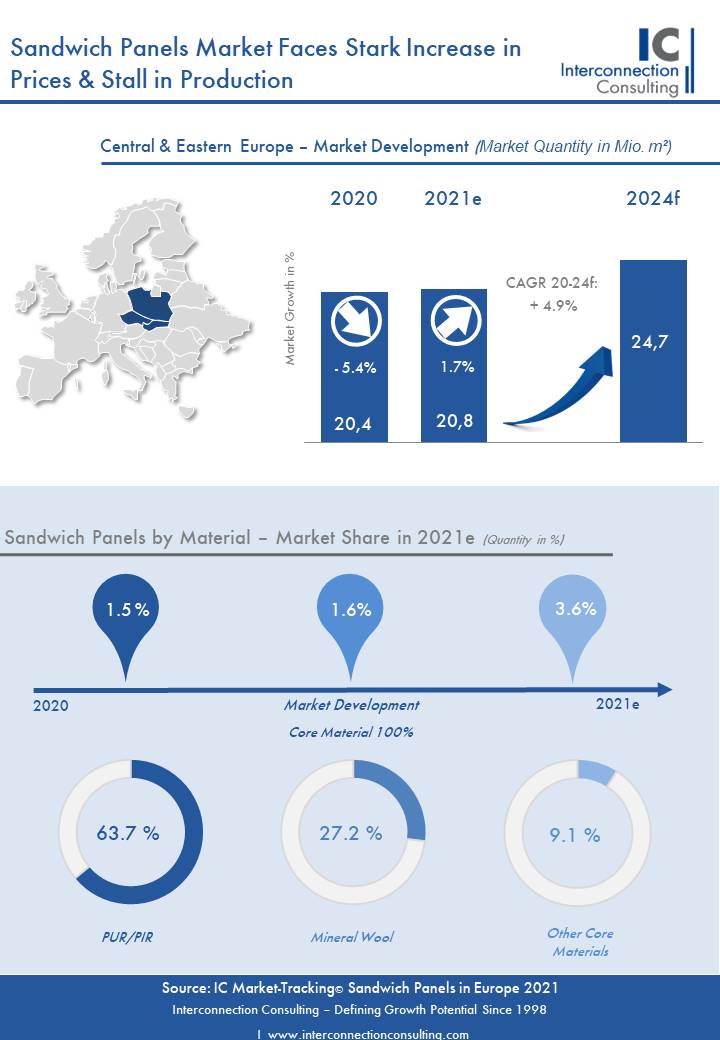

The market for sandwich panels is experiencing a shortage in steel production as a result of the COVID crisis, which in turn leads to immense price increases. The market in the CEE countries Czech Republic, Slovakia and Poland is also affected by this. For 2021, Interconnection Consulting forecasts an increase in market volume in these countries of 32.1%, while sales volume will almost stagnate (+1.7%).

The experts are…

The market for sandwich panels is experiencing a shortage in steel production as a result of the COVID crisis, which in turn leads to immense price increases. The market in the CEE countries Czech Republic, Slovakia and Poland is also affected by this. For 2021, Interconnection Consulting forecasts an increase in market volume in these countries of 32.1%, while sales volume will almost stagnate (+1.7%).

The experts are optimistic that the steel supply crisis will soon be over. A recovery in this regard is expected as early as 2022. The resulting drop in production costs will also lead to rising sales figures. In Poland, prices increased by almost 6% in the last quarter of 2020 alone. At the beginning of 2021, this trend continued at an exponential rate. Overall, Poland, like many other countries, showed a noticeable shortage of labour and reluctance to invest in new construction during the pandemic. This resulted in sandwich panel sales in 2020 falling back down to 2017 levels (-6.4%). By 2022, Interconnection expects a return to the level just before the crisis struck. The slump in the Czech Republic was not quite as severe in 2020, but while sales in Poland have rebounded strongly this year, the decline in the Czech Republic continues at an accelerated pace (-5.0%). The reason for the decline in sales is primarily the price increase for raw materials. The same applies to Slovakia, where sales have fallen by 4% this year.

Eco-Friendlier Materials Sought

Products with higher insulation and fire resistance, (e.g. mineral wool and thicker) are also on the rise due to EU regulations. There could also be a shift towards more ecological, such as halogen-free products, explains Katarina Gajdova, the author of the study. Overall, the study shows that steel dominates the market as a covering material with almost 98 percent. As a filling material, PUR/PIR (panels with synthetic insulation materials) dominate with about two-thirds of the market share. Mineral wool accounts for about one third. Important companies active in the CEE region are Balex Metal, Gor Stal, Kingspan and Ruuki.

[^]Price Increases Cause Turnover to Rise and Sales to Fall

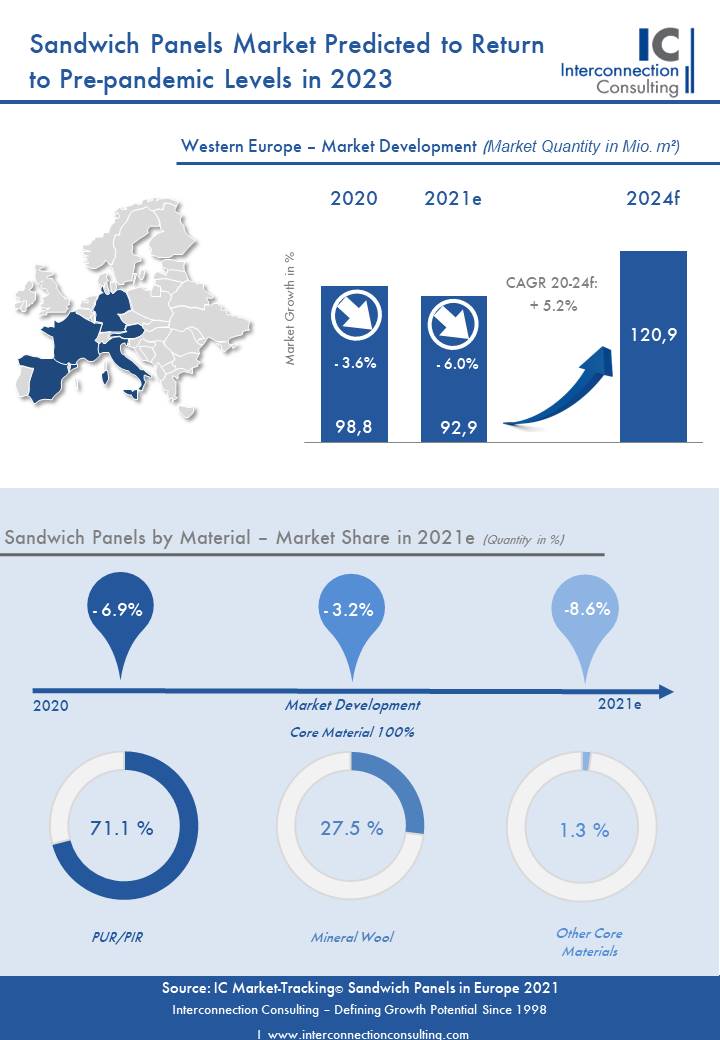

The market for sandwich panels for thermal insulation of buildings was affected by high price increases during the pandemic, due to shortages in the steel sector. While the market volume in value terms will increase by 16% in Western Europe this year, sales will decline by 6% compared to last year, according to a study by Interconnection Consulting.

The pandemic saw a halt in the production and export of steel production,…

The market for sandwich panels for thermal insulation of buildings was affected by high price increases during the pandemic, due to shortages in the steel sector. While the market volume in value terms will increase by 16% in Western Europe this year, sales will decline by 6% compared to last year, according to a study by Interconnection Consulting.

The pandemic saw a halt in the production and export of steel production, which mainly brought imports from China, the world’s largest steel producer, to a standstill and resulted in a shortage of the most important cladding material for sandwich panels. Experts expect the situation on the steel market to return to normal in 2022 and prices to move southwards again. The strongest price increases in 2020 were seen in Spain with +10% and France and Austria with +8% each. On a positive note however, the experts’ gloomiest forecasts, which expected prices to rise by 20 to 70%, were not fulfilled.

France Faces a Sharp Slump

While all the countries studied expect a positive turnover trend due to the enormous price increases, which will accelerate again in 2021, sales in all countries will drop sharply this year due to the shortage in the steel market and lower demand. In France, a slump of almost 11% is expected. In Spain, forecasts expect a decrease in sales of around 7%. Germany and Austria will lose about 5% of business. Italy will lose another 3% in sales this year after a 9% slump in 2020. “This is not helped by subsidy measures such as the Superbonus 110, which applies mainly to residential construction, where sandwich panels are not so popular,” explains Katarina Gajdova, the author of the study.

Mineral Wool Catches Up

Steel is the outstanding covering material for sandwich panels with a share of 93.5%. Aluminium is less popular among manufacturers and consumers due to its lower insulating power. When it comes to insulation material, the ecological orientation of products, such as halogen-free, is also becoming increasingly important, as Gajdova explains. Overall, synthetic insulation materials dominate the market with about 71%, but are losing a little market share to mineral wool, which accounts for about a quarter of the market. Important producers of sandwich panels in Western Europe include Brucha, Isopan, Lattonedil and Metecno. Earlier this year it was announced that the Irish company Kingspan, one of the largest players in the sandwich panel market in Europe, had bought the steel division of the Romanian group Teraplast.

[^]Curtain Wall Market is Facing Difficult Times

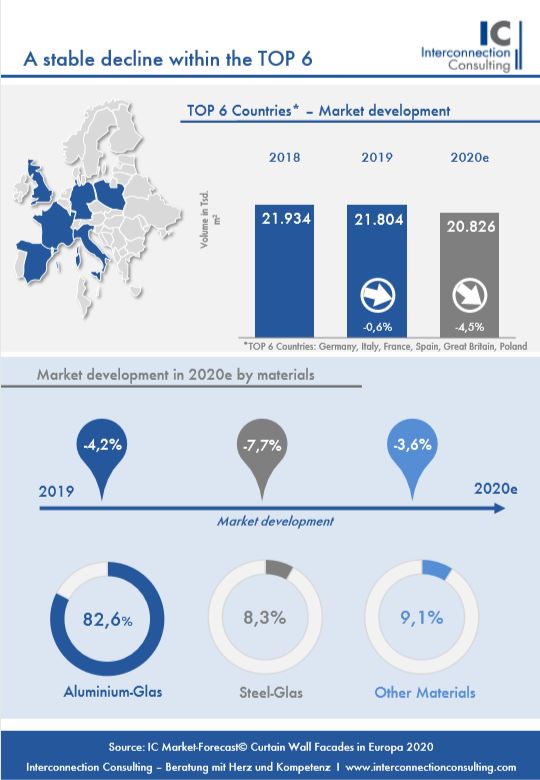

The six most important markets for curtain walls in Europe (Germany, France, Spain, Great Britain, Italy and Poland) posted a decline in sales of 0.6% in 2019. Follwoing the most likely scenario, the COVID crisis will cause a sharp drop in sales this year (-4.5%). But even after that, the market will find it very difficult to get going, as shown in a study by Interconnection Consulting.

Ray of Hope in Two Years

The decline…

The six most important markets for curtain walls in Europe (Germany, France, Spain, Great Britain, Italy and Poland) posted a decline in sales of 0.6% in 2019. Follwoing the most likely scenario, the COVID crisis will cause a sharp drop in sales this year (-4.5%). But even after that, the market will find it very difficult to get going, as shown in a study by Interconnection Consulting.

Ray of Hope in Two Years

The decline in sales across Europe – in the most likely scenario – will continue until 2022. While sales in the previous year were around 21.8 million square meters, they will most likely only make up 19.8 million square meters in 2023, as a low demand for new investments in the construction industry is expected until 2022. The developments caused by the crisis in the individual countries are all different. Italy will experience the largest decline in 2020 in the most likely scenario (-12.2%), followed by Great Britain (-9.9%), although it can be said that for both countries this is simply continuing their decline in sales. By far the largest market, Germany, will lose 3.8% of its sales volume this year, ending a long upward phase. On the other hand, France and Poland will actually end 2020 with a slight increase in sales. However, sales volumes in these countries will also decline sharply in the following years due to the consequences of the crisis.

Trending New Materials

In terms of materials, aluminum-glass holds the majority with a share of 82.6%, followed by steel-glass. While the steel segment continues to lose shares, aluminum will continue to expand its market position. However, the strongest trend can be seen in other materials, such as wood-aluminum or wood-glass systems. Alternative elements such as stone, ceramic or plastic are also being used more and more frequently.

Housing Construction Will Collapse

The market share of property construction is 89.5%. With almost half of total sales, the office segment is the strongest customer segment. This is followed by retail (18.7%) and industry with 14.1%. The greatest losses are expected in residential construction, whose sales will fall by 8.3% this year. Around three quarters of the sales volume is used in new construction.

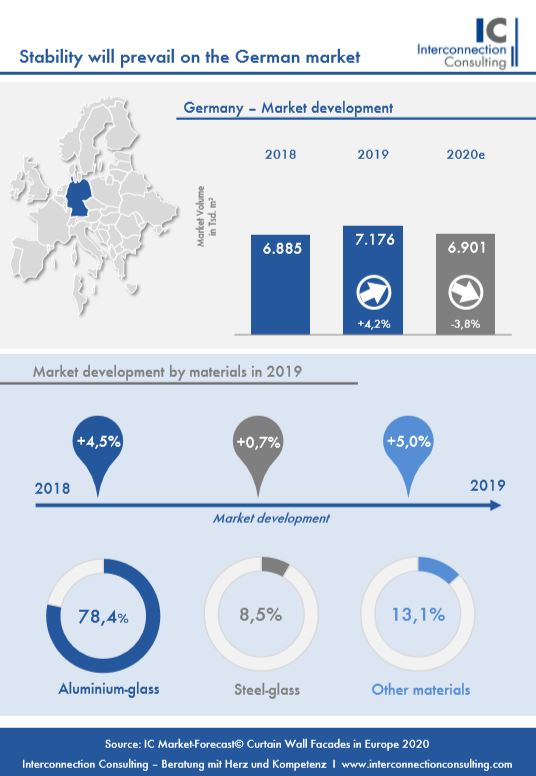

[^]Curtain Wall Industry in Germany Will Only Recover Slowly

Sales of curtain walls increased in 2019 by 4.2% to 7.2 million square metres. In 2020, sales are set to decline by 3.8% due to COVID-19, as shown in a new study by Interconnection Consulting. The industry will only slowly recover from the effects of the pandemic by 2023.

In 2020, due to the consequences of the shutdown, sales will most likely decrease to 6.9 million square meters, as the study shows. By 2023, this value will…

Sales of curtain walls increased in 2019 by 4.2% to 7.2 million square metres. In 2020, sales are set to decline by 3.8% due to COVID-19, as shown in a new study by Interconnection Consulting. The industry will only slowly recover from the effects of the pandemic by 2023.

In 2020, due to the consequences of the shutdown, sales will most likely decrease to 6.9 million square meters, as the study shows. By 2023, this value will increase slightly, up to 7.0 million square meters. The crisis is set to end the continuous growth of the industry in recent years. The industry recorded an increase from 6.0 to 7.2 million square meters in the five years between 2014 and 2019.

Wood on the Advance

Aluminum is the dominant product group with a share of 78.5% and is not set to lose any of this majority in the future with above-average market growth. Lower growth and thus falling market shares can be expected for steel-glass combinations. The strongest upward trend is the wood-glass combination. „The advantages of the trend-material, like sustainability aspects and easy handling contribute to the rise of this material group. In addition, wood is renewable and resistant and has very good thermal insulation, ”explains Daniel Kollar, the author of the study.

Trade and Industry are Catching Up

The strongest sales segment by far for curtain walls is the office segment with a share of 43.2%, followed by the retail segment with 21.5% and industry. Only then comes the residential segment, which so far only accounts for 12.3% of total sales. This proportion will not increase until 2023. On the contrary, the residential segment will continue to lose shares, while the retail and office sectors will see the largest growth rates until 2023.

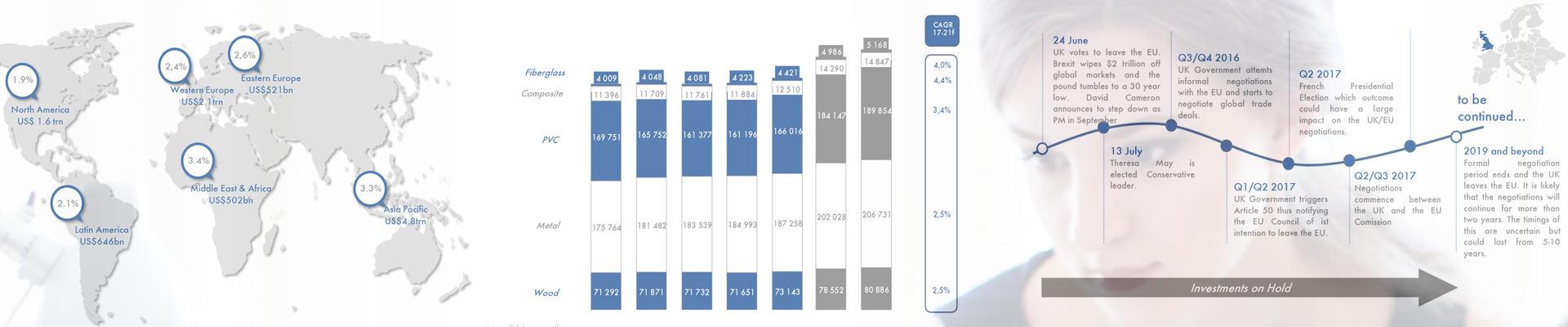

[^]Rainscreen Cladding Facades with Further Growth

The facade cladding market for Rainscreen Cladding Facades in Europe + USA (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Norway, Poland, Russia, Slovakia, Spain, Sweden, Switzerland, Czech Republic, Netherlands, United Kingdom, United States) increased its sales by 4.0% in 2018, with some significant differences between the different countries. Overall, Interconnection Consulting expects average annual growth…

The facade cladding market for Rainscreen Cladding Facades in Europe + USA (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Norway, Poland, Russia, Slovakia, Spain, Sweden, Switzerland, Czech Republic, Netherlands, United Kingdom, United States) increased its sales by 4.0% in 2018, with some significant differences between the different countries. Overall, Interconnection Consulting expects average annual growth of about 4-5% (4.1% in volume, 5.6% in value) in a new study by 2021.

Development Consistently Positive

A closer look at the markets examined, shows that overall sales figures have risen steadily in recent years. While Austria only grew by 2.1% in 2018, the Czech Republic achieved growth of a respectable 7.4%. Germany achieved growth of 5.0% in volume in 2018, outperforming Italy (+ 4.5%) and the United Kingdom (+ 1.6%), shaken by the Brexit uncertainties. Despite the growth and the advantages over the whole lifecycle of the facade (energy-saving measures, reduced maintenance work, uncomplicated dismantling, etc.), the necessary higher initial investment in the acquisition of Rainscreen Cladding (compared to conventional facades) slows down growth even more. Thus, depending on the type of building, there is also substitution with industrial facades, ETICS, sandwich panels and curtain wall facades. The trend towards more daylight, which favors curtain walls, remains another obstacle. In addition, non-residential construction was not able to grow as strongly in most countries as residential construction, where Rainscreen cladding facades still tend to be under-represented, as compared to non-residential construction (office buildings, government institutions, commerce, others).

Wide Range of Cladding Materials

A Rainscreen Cladding façade can be defined as a multi-layered exterior wall construction. Here is the outermost layer that serves to protect against driving rain. The construction consists of the facade cladding, the ventilation zone, the insulation and the substructure. The cladding may consist of various shapes and types of panels /bricks / sidings, made out of: aluminum, steel / metal, wood, natural stone, fiber cement, HPL, ceramics, concrete / stone, vinyl, plaster base plates, etc; Aluminum (composite) is one of the most popular cladding materials, accounting for 27.3%, with fiber cement (17.4%), metal, ceramics and “other materials” being among the most important groups of materials.

New Construction Stronger Than Renovation

In the residential segment, the rate of Rainscreen Cladding Facades, is usually lower than in the non-residential sector in most of the countries surveyed. Italy accounts for only 9.6% of the lowest share, probably due to the high costs, while countries such as Denmark and Finland account for an above-average proportion of the residential segment, while most other European countries having a share of the residential sector of ¼ to a ⅓ of the total Rainscreen cladding market.

A very dominant position occupies “new construction” compared to the “renovation” area. In the Czech Republic, for example, 81.5% of newly installed Rainscreen cladding facades are installed on the new building, with Austria not far behind with just under 80%. The end of the spectrum is formed by Switzerland and Spain, with a significantly lower share, where the renovation sector is much more pronounced.

Leading manufacturers of cladding materials / panels that are installed as a Rainscreen cladding façade, include companie like Etex, Cembrit, Swiss Pearl, Trespa, 3A Composites, Fundermax, Rockpanel, Sto, Resopal, Agrob Buchtal, Prefa, or Eternit, to name a few. Closely related to the industry are also manufacturers of facade fastening systems (anchors, substructures, facade dowels, adhesives and the like) such as Hilti, Fischer, Schock, Sika, Ejot, Sto, BWM, Systea, Allface, Nauth, etc. and insulation manufacturers such as e.g. Rockwool, or Saint-Gobain, etc.

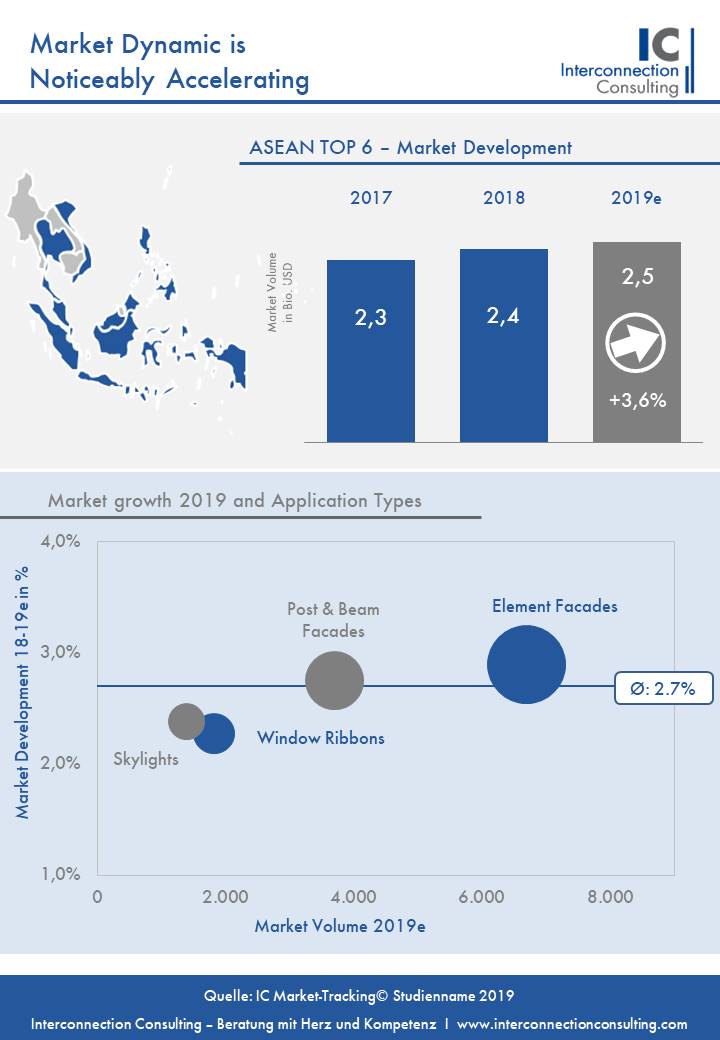

[^]Dynamic economy in Southeast Asia is making a quick comeback

The market for curtain walls in the ASEAN countries (Singapore, Malaysia, Indonesia, the Philippines, Vietnam, Thailand) is bound to plummet by 9.6% this year due to the COVID-19 crisis. However, the market will recover very quickly and by 2022 will have already exceeded the pre-crisis market volume, as a new report by Interconnection Consulting shows.

Good conditions for a quick rebound

The integration of the ASEAN region…

The market for curtain walls in the ASEAN countries (Singapore, Malaysia, Indonesia, the Philippines, Vietnam, Thailand) is bound to plummet by 9.6% this year due to the COVID-19 crisis. However, the market will recover very quickly and by 2022 will have already exceeded the pre-crisis market volume, as a new report by Interconnection Consulting shows.

Good conditions for a quick rebound

The integration of the ASEAN region into the global industrialization process, as well as into global tourism and the construction sector, offers strong impulses for the construction industry. The wave of urbanization is also a strong driver of the construction industry and is even more dominant in the ASEAN countries than in Europe or the USA. These factors are decisive for the construction industry and thus also the market for curtain walls to keep going faster than e.g. in Europe.

Vietnam benefits from the trade war

Indonesia and the Philippines are not only the most populous ASEAN countries, but also the most dynamic markets, recording an astounding growth level. Indonesia is also the largest market for curtain walls in the ASEAN region with a share of 32.5%. Vietnam benefits from the trade war between China and the United States, as many foreign factories move from China to Vietnam to avoid trade tariffs. Therefore, despite Corona, the industry growth in Vietnam will average 2.4% annually over the next few years until 2022. By contrast, while Singapore and Thailand have poorer growth prospects, Malaysia has stable growth prospects.

Smart working instead of office presence

The most important material type is reportedly aluminum glass, with a lion’s share of 84.3%. Above all, it is the cost efficiency that speaks for aluminum and against e.g. Steel / glass, which only has a market share of 8.0%. The largest application area for curtain walls is office buildings with a share of 32.8%. In contrast to many other regions, the residential sector (e.g. apartments) remains a very important segment for curtain walls in Southeast Asia at 27.2% of the total. There could also be shifts in favor of co-working spaces in the future. “There will be more smart working and it is likely that there will be less office space for the same number of employees,” stated Vito Graziano, author of the report. Furthermore, it can be expected that the new development of hotels will only progress very slowly in the next few years due to setbacks in tourism.

Downward trend in raw material prices strengthens margins

Overall, the renovation sector makes up a small chunk of the market with around 15% of the total volume. Conversely, new construction makes up for a share of 85.7%, and this trend will not change in the next few years. But the corona crisis also has immediate positive effects for producers: in the wake of the corona crisis, raw material prices are on a downward trend worldwide, which should strengthen the margins of facade manufacturers overall.

[^]Leading Companies trust in Interconnection Consulting

Kontron

The most important benefit of the Impulsworkshop "sales optimization" was in my view the procedure of the definition of strengths and the entire sales process. Mr. Berger is very competent and professional. Fabian Freund (Sales Manager, Kontron Austria)

ELK

The prefabricated housing study by Interconnection Consulting shows a real picture of the actual market situation and forms a valuable basis for our strategic decisions.

Gerhard Schuller (CFO ELK)

ELK

The prefabricated housing study by Interconnection Consulting shows a real picture of the actual market situation and forms a valuable basis for our strategic decisions.

Gerhard Schuller (CFO ELK)

Epson

EPSON is satisfied with the Interconnection's way of communication with the market and with clients. EPSON is also appriciate the Interconnection's continuous work trying to aim the report to be at the higher level. As a result, EPSON rely on Interconnection data, for the market of POS Printers and Systems.

T.Murakami (Brand Management, Seiko Epson Corporation)

Gaulhofer

I appreciate on the forum "Impulsworkshop Vertriebsoptimierung" the practical relevance of Peter Berger linked with his practical examples. I also liked the sovereign presentation style. The most important benefit was for me, on the one hand refresh of methods and also the sales management tools that were shown. Ing. Dietmar Hammer (Head of Product Management Gaulhofer)

Kontron

The most important benefit of the Impulsworkshop "sales optimization" was in my view the procedure of the definition of strengths and the entire sales process. Mr. Berger is very competent and professional. Fabian Freund (Sales Manager, Kontron Austria)

Österreichs Personaldienstleister

The sales management tool "Jobs Intelligence Austria" has become indispensable for many Austrian temporary staffing providers for fast and correct strategic management decisions as well as a daily support tool for hot leads for the sales team. Interconnection Consulting has consider individually to all user needs during development process and also convinces with fast response times during operation.

Dr. Gertraud Höltl (Generalsekretärin Österreichs Personal Dienstleister)

Saint Gobain

Long experience and deep understanding of the construciton industry markets make up the quality of the IC studies. Interconnection Consulting is a constant companion concerning the assessment of markets and helpful for decision-making.

Bernd Blümmers (Directeur General, Saint-Gobain Solar Systems, Central Europe, Aachen)

Salamander

Interconnection Consulting reports deliver a worthfull external perspective and are so a good contrast with regards to our internal market point of views.

Pedro Posada (CEO Salamander Industrial Products Spain)

Scandinavian Business Seating

The IC Report gives a very good overview of the Western European office furniture market, in a well-structured way. The data is helpful to better understand the market developments and drivers.

Beatrice Sotelo (Director Business Development , Scandinavian Business Seating)

Schneider Electric

Under a short time constraint, Interconnection was able to deliver an outstanding study that exceeded my expectation in terms of quality and market breadth. I highly recommend Interconnection to anyone in need of market research.

Jeff Canterberry (Director of Strategy and M&A, Schneider Electric)

Sodexo

When developing new market strategies, Interconnection is a trusted source we always come back to. Christian Frey (Marketing Manager CS DACH)

Do not hesitate to contact us

Please describe your needs or request a callback. We look forward to hearing from you and contact you immediately.

Thank you very much for contacting us!

Our expert will contact you as soon as possible

Thank you for your Newsletter registration.

You will receive an automatic confirmation of registration at your specified email address.

Thank you for your order.

Please return the signed order form via email to office@interconnectionconsulting.com or via fax +43 1 5854623 30.

Thank you for your interest.

You will shortly receive the information material to the specified e-mail address.

For questions, we are happy to help!

Thank you for your interest.

You will shortly receive the information material to the specified e-mail address.

For questions, we are happy to help!

© 2025 Interconnection Consulting | Imprint | Privacy-Protection